proposed federal estate tax changes

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. These changes would dramatically increase the number of taxpayers subject to the estate tax and would eliminate many common estate planning techniques.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on appreciated assets transferred during life or at death How do I protect my assets from estate tax.

. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11. Decreased Estate Tax Exclusion.

Lowering the estate tax exemption The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which. In addition the proposed rule would make death a transaction. Another proposal would bring new rules to grantor trusts including a change to how life insurance held in a trust would be taxed12 At this point many ideas are being evaluated but nothing is final.

One of the proposals would reduce the estate tax exemption to anywhere between 35 and 5 million with an effective date of January 1 2022. The top federal capital gains tax rate would also increase to 25. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for.

The maximum estate tax rate would increase from 39 to 65. In addition to the Federal Estate Tax changes the bill raised the top individual tax rate from 37 to 396 increased the capital gains tax rate from 20 to 25 capped the 20 qualified business income deduction at 500000 and added a 3 surcharge for taxpayers with more than 5 million in income. Here is what we know thats proposed.

Lower Gift and Estate Exemptions. On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most extensive changes to the federal estate and gift tax in decades. The proposed rule would mandate that the heirs would take on or carry-over the basis of the decedent.

Thus in the example above. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Two of the most significant proposed changes include.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. The top federal income tax rate for estates and non-grantor trusts would increase to 396. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both.

Capital gains tax would be increased from 20 to 396 for all income over 1000000. Brackets will then reset annually based on inflation. A proposed change could impact your estate.

It could potentially be signed in a different form where the proposed revisions are brought back in. Estates and non-grantor trusts would also be subject to a 3 tax surcharge on modified adjusted gross income which includes ordinary and capital gains income over 100000. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Serhii Krot Shutterstock. Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022 For 2022 the administration is proposing to increase the top income tax rate for individuals from 37 to 396 applicable to incomes over 452700 for individuals or 509300 for joint filers.

The current estate tax exclusion for an individual is 117 million effectively 234 million for married couples. The federal government offers a 15000 gift tax exclusion which means you can give individual loved ones that amount. Under the SandersWhitehouse proposal the estate tax rate would be increase to 45 for taxable estates valued between 35 million and 10 million 50 for estates over 10 million but less than 50 million 55 for estates between 50 million and 1 billion and 65 for estates over 1 billion.

Inheritance Tax Regimes A Comparison Public Sector Economics

Delaware Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Definition Federal Estate Tax Taxedu

Inheritance Tax In The Uk Explained Infographic Inheritance Tax Inheritance About Uk

Estate Tax Law Changes What To Do Now

How Could We Reform The Estate Tax Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan How To Plan Irs

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Irs Gives Wealthy Families More Time To Shelter Assets From Estate Tax Wsj

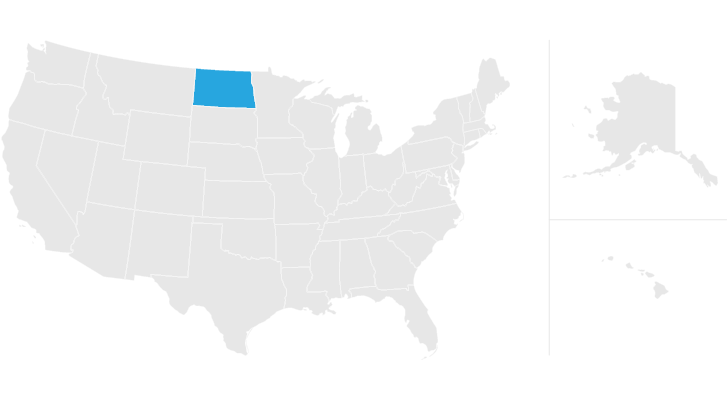

North Dakota Estate Tax Everything You Need To Know Smartasset

New Estate And Gift Tax Laws For 2022 Youtube